On September 2nd and 3rd four pit stops are planned in Athens to discuss a business-driven Solvency II approach. On Thursday, the stops are at the large insurance companies Interamerican and Eurolife and on Friday they will be at Commercial Value and Victoria Insurance. The pit stops are facilitated by a combination of three international operating companies: SPIRIT, IDS Scheer The Netherlands and SecondFloor.

With customers like ING, SecondFloor has proven that they are capable of providing the insurance market with excellent software for among other things, economic capital calculations and reporting. With their products and developments, SecondFloor covers a number of SII requirements in pillars I (implementation), II (control) and III (disclosure). Based on this, insurers can hold sufficient regulatory capital to ensure that they are protected against adverse events. As a platform for the ERM and Compliancy solutions, IDS Scheer’s ARIS and ARIS Risk & Compliance Manager, cover most SII requirements of pillar II (control). It’s a business-driven solution for governance and risk management in the insurance branch. For more information about enterprise risk management you can read an earlier ERM blog in the GRC Lounge. The consultancy skills of the local player SPIRIT complete the mix of software and consulting in SII programs. Spirit enables top management to foresee potential risks in processes and implement the necessary process controls for their mitigation.

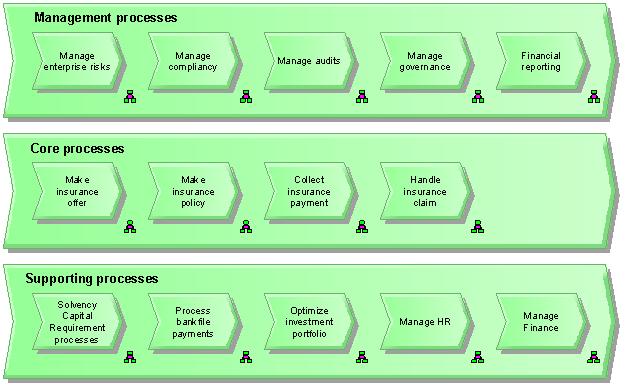

The approach of the three companies is business-driven. Based on Solvency II requirements, solutions are defined within the processes of insurance companies. Figure 1 shows an example of a selection of insurance processes at the highest level of detail. Digging deeper into the processes gives insight into the risks that were identified and the mitigating controls and procedures needed to meet a huge number of SII requirements.

Figure 1: Process Map of an Insurance company (example)

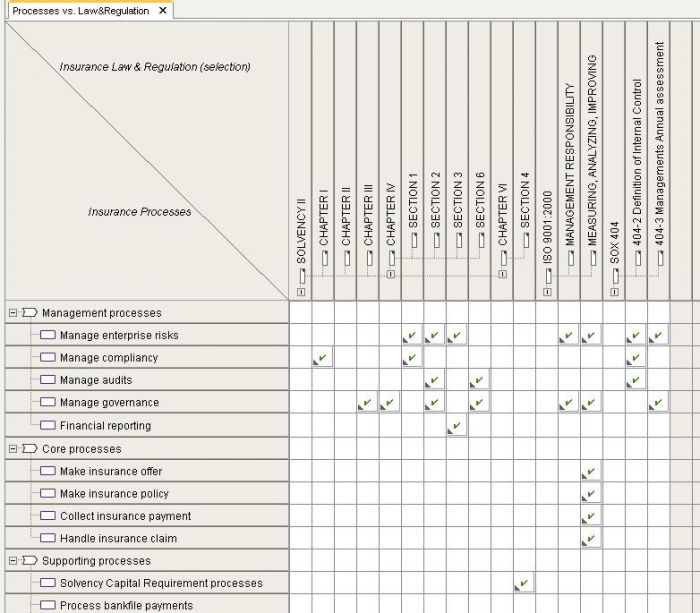

Figure 2 shows an example of the mapping of insurance processes with laws (such as Solvency II), regulations (like SOx) and codes (like ISO). You can see that a lot of sections of SII are covered by a sufficient ‘Manage enterprise risks’ and ’Manage compliance’ process, which is supported by ARIS Risk & Compliance Manager. The Solvency Capital Requirement process is partly covered by SecondFloor products and supporting processes. Well-defined processes with embedded controls can meet the requirements of several laws, regulation and codes. An earlier blog about an integrated approach describes this more in detail.

Figure 2: Mapping of law & regulation versus insurance processes (example)

It helps to have a system in place where the defined solutions (processes, controls, supporting IT solutions) are documented centrally in one repository. Are you interested and active in the insurance industry but not working in Athens this week? Don't worry, simply contact us with your remarks and questions.